Hospitals/Large Healthcare

Ideal for:

Benefits & Insurance Solutions

Employee Benefits, Retirement Services, Property & Casualty Products

Through the WHA partnership with Healthcare Benefits Alliance Trust (HBA), WHA members have access to a comprehensive array of services with preferred pricing for employee benefits, retirement services, and property and casualty products.

For rural hospitals facing unprecedented staffing and cost challenges, HBA delivers the competitive benefits and cost stability you need to serve your community.

Saving Money & Increased Purchasing Power

Balanced Risk

The size of the HBA program spreads and balances the risk over 1,000,000 insured lives.

Expense Control

Fixed expenses are spread over a larger premium base which allows the HBA program to have a more competitive permissible loss ratio (more of your premium dollar goes towards paying claims).

Cost Stability

The power of larger numbers allows the program to enjoy a higher credibility to be placed on the prospective rating (funding) of the program than an individual organization.

Purchasing Power

Huge value in achieving economies of scale. With further alignment of administrative procedures and the potential to standardize plan provisions, pricing becomes even more competitive.

Pharmacy Benefit Manager

Seamless integration with WHA’s Community Care Alliance’s CCA Rx PBM.

HBA delivers the expertise, solutions, and services that rural healthcare providers need to attract and retain talent, support the diverse needs of employees and their families, and thrive.

Life, Disability,

& Medical Stop Loss

& Medical Stop Loss

Benefits

Administration

Administration

Physician/Executive

Benefits

Benefits

Rx Program-

Carve out with CCA Rx

Carve out with CCA Rx

Dental Fully

Insured & ASO

Insured & ASO

Absence

Management Services

Management Services

Vision

Care

Care

Dependent

Eligibility Audits

Eligibility Audits

Medical Claim

Analysis

Analysis

In-house

Weight Loss Clinics

Weight Loss Clinics

Provider Network

Design & Negotiation

Design & Negotiation

Rx Rebate Program

for Community

for Community

WHA’s Community Care Alliance’s Pharmacy Benefit Plan, CCA Rx, can help you navigate the confusing process and take care of it for you!

What if you could save money for not only your organization, but also your employees? To date, the CCA Rx has achieved close to 50% savings for members compared to previous PBM relationships. Additionally, the CCA Rx consistently provides a significantly higher rebate per script, while member (employee) costs per script are down.

If you are a self-funded employer, you are eligible to participate in CCA Rx.

- Complete control and flexibility with formulary development and management. You also control who fills your scripts and your physicians develop prescribing patterns appropriate for your area.

- Ability to customize your formulary to meet employee needs. This includes options for specialty and other high-cost drugs.

- Complete transparency with your prescription plan and where the money is going. This includes what you are paying for the drug, fill/admin fees, and 100% of downstream rebates are returned to the individual employer plan, which are not shared between a PBM and broker.

- Access to 340B pricing for members when appropriate.

- Easy to implement and manage as the program aligns with your insurance plan renewal, with zero disruption. The CCA works with FairScript to manage the program and report back to you.

- Added employee benefits per individual organization’s discretion. Example: waived deductible and co-pays, travel reimbursements, etc. for employees who utilize participating pharmacies.

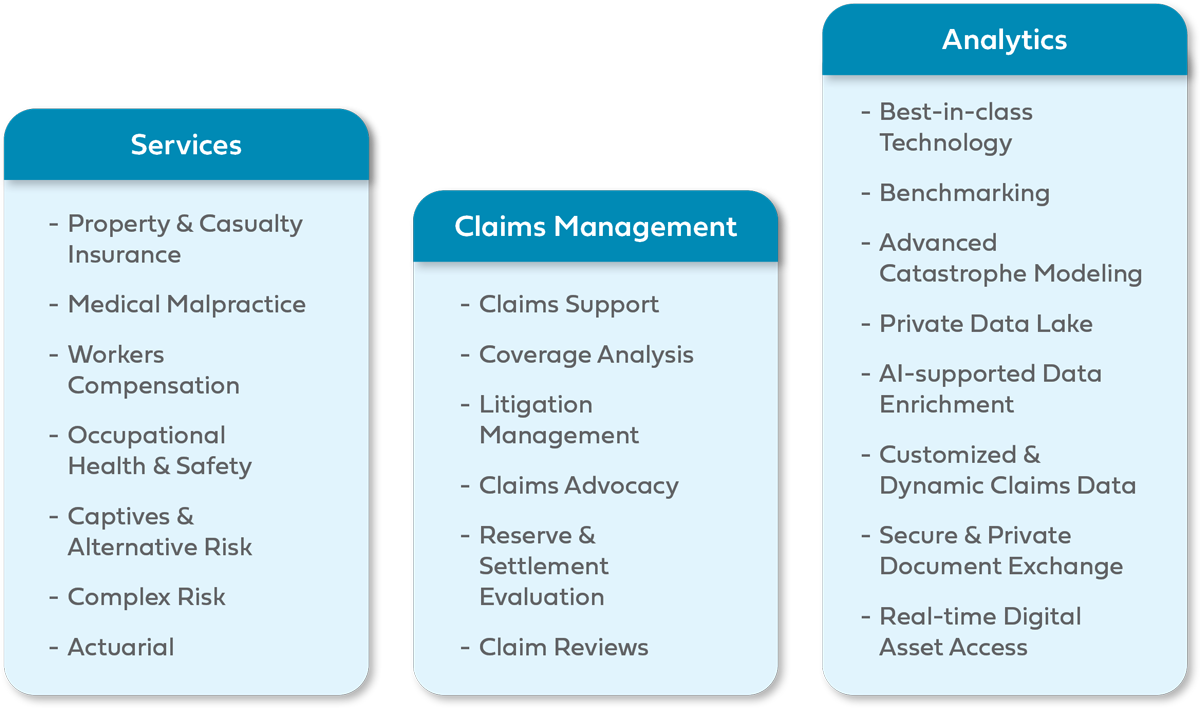

HBA’s client-centric approach supports long-term relationships focused on empowering you to overcome their most significant risk management challenges.

Their experts across industries, products, and programs work closely with you to understand your specific risk exposures, develop customized insurance solutions, and provide proactive insight and support to enhance outcomes.

Helping you understand and mitigate risk!

When it comes to setting up and managing retirement plans, doing “OK” isn’t doing nearly enough.

Team Focus to Drive Retirement Plan Success

Your plan must conform to multiple regulations. You need to pay reasonable fees and offer competitive funds, while checking off every fiduciary responsibility box.

On top of that, employees need support on how to engage your retirement and benefits offerings you provide.

Services Offered Include:

Investment Analysis

Fee Benchmarking & Negotiations

Fiduciary Compliance

Plan Design

Participant Education & Financial Wellness

Target Date Fund Consulting

HBA was formed in 1993 in response to the first wave of healthcare reform conversations on Capital Hill. As a result, hospital leaders came together to gain greater negotiating power and rate stability by collaborating on health and welfare benefits. Today HBA includes hospitals, physician groups, colleges with medical schools or health sciences programs, and healthcare-related companies. HBA covers over 960 entities representing nearly 1 million covered lives. With a sole healthcare focus, HBA has six of the leading insurance carriers who guarantee participating hospitals the best savings possible.

HBA is an arm of Alexander Benefits Consulting (ABC), a Colorado-based employee benefits broker. Established in 1998, ABC has differentiated itself as an early thought leader in the healthcare, higher education, and non-profit industries.

ABC is owned by NFP, an Aon company, is an organization of consultative advisors and problem solvers helping companies and individuals address their most significant risk, workforce, wealth management, and retirement challenges. With colleagues across the US, Puerto Rico, Canada, UK, and Ireland, we serve a diversity of clients, industries, and communities. Our global capabilities, specialized expertise, and customized solutions span property and casualty insurance, benefits, wealth management, and retirement plan advisory.

This combined power makes HBA a great fit for WHA members and can help ease the burden rural providers deal with on a daily basis.

Contact

Mike Cole

Senior Vice President

Alexander Benefits

303.296.3123

mcole@alexanderbenefits.com

www.alexanderbenefits.com

John Hohman

Managing Director

Alexander Benefits

925.297.6155

john.hohman@alexanderbenefits.com

www.alexanderbenefits.com